In the second year, you should monitor your miles for a three-month sample interval. To make the process as simple as possible, contemplate doing this in the course of the first three months of the tax yr. During this period, observe your whole mileage in addition to the driving you do for your corporation. Then, calculate the proportion of the time you used your automobile for work, and evaluate that quantity to the percentage of time you used the automobile for work during the base yr. To make mileage logging simpler for small business owners, the CRA additionally provides a simplified system. With this technique, you must track each single kilometre you drive for work in the course of the first 12 months you utilize the automobile for business.

Does Quickbooks Observe Mileage Accurately: Check Drive Outcomes

- To make sure the accuracy and integrity of your mileage data, QuickBooks permits users to add vehicles driven for enterprise functions.

- In late June 2023, Intuit combined QuickBooks Time and QuickBooks Workforce mobile app functionalities to start the brand new QuickBooks Workforce app.

- The IRS requires that you just hold your mileage logs for 3 years—whether a paper-and-pencil mileage log you retain in your glove field or a digital mileage log saved on your telephone.

- Overall, FreshBooks wants improvement in reliability and customization to enhance person experience.

You can also verify the support website of your system’s manufacturer for details. Make certain you’ve allowed the QuickBooks Self-Employed app to run in the background. Don’t hesitate to contact us if we can help together with your use of QuickBooks On-line and/or your general accounting. Do you ever end up opening QuickBooks On-line in a model new tab as a result of you should examine something in another part of the location but don’t wish to shut down your present screen? If you’re accessing QuickBooks On-line by way of Google Chrome, it’s easy. Right-click anyplace within the navigation toolbar that contains links (not the clean house below) and choose Open hyperlink in new tab.

The app is straightforward to use, and is extremely rated in the app stores by Android and iPhone customers. Rydoo is a modern-looking app that gives a wide range of providers to help with expense management that’s streamlined extraordinarily nicely. It provides its fair proportion of perks, corresponding to its capacity to digitize receipts using AI, instant transaction evaluate, and Google Maps integration. QuickBooks Self-Employed may be generally identified as a bookkeeping app, but what is less recognized is that it also has a built-in automated mileage tracker that is very good. In my check, the whole app used only 2.73 MB of cellular information whereas solely consuming by way of a median of zero.04% of my phone’s battery per hour.

Not to mention, mileage reporting also supplies useful knowledge for all tax deductions, full business efficiency analysis, cost allocation, and so on. Not to mention, QuickBooks Online can generate reports and consider mileage data with ease, offering a complete business answer for efficient monetary management. In addition to it, such reviews play a pivotal role for businesses to make strategic choices related to expenses and operations. If you have not already, set up the automatic mileage monitoring feature. MileIQ presents forty free drives per month, Everlance provides a restricted free plan and Driversnote consists of handbook logging without charge. These are great starters however check if journey limits or lacking options may price a little quickbooks mileage tracker app you more in the lengthy term.

The app’s mileage monitoring is often famous as reliable, though some customers point out occasional dropped journeys. However, not all customers stick with the service, and some have opted to cancel. General, Everlance is valued for its functionality and cost-effectiveness, being significantly helpful for each private and enterprise functions.

SherpaShare is a mileage tracking and driver productivity app built specifically for gig economic system employees similar to Uber, Lyft, DoorDash, and Instacart drivers. The free model has some limitations, similar to a monthly restrict on the variety of journeys you can log and restricted reporting options. Your automobile costs and gasoline utilization will be stored in check if you keep a gas log and document your automotive expenses.

Zoho Expense

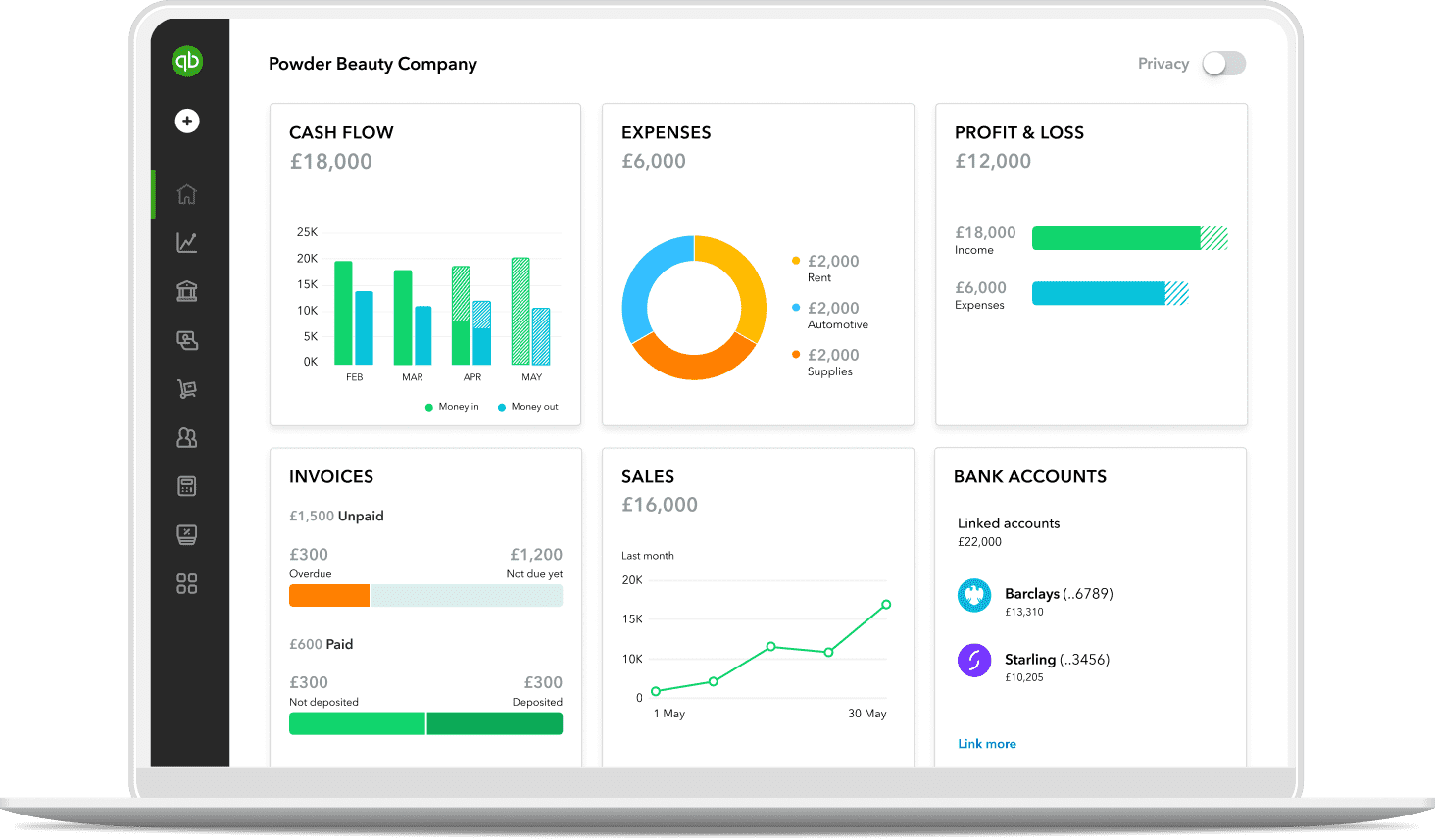

That visibility issues if you’d like a tool that your accountant already knows, your employees have in all probability used and your tax software program will settle for with out clarification. QuickBooks Online is the best for accounting because mileage lives inside the same ledger you already use for invoicing, bills and reporting. Trips you capture within the mobile app roll into your books with the proper classes, so deductions present up where your accountant expects them. You can provide workers limited entry, require approvals and keep an audit trail, which helps if a number of folks submit mileage.

It delivers reports in PDF/XLS format with detailed fleet usage statistics about when, where, and how briskly you can go. It makes use of GPS to mechanically detect and log drives, even without an internet connection, and stores the data until you reconnect. Plus, you get statistics like total and average variety of fill-ups, mileage, and gasoline prices in a neat, easy-to-use format.

Commonplace Deduction Calculator

Extra features embrace adjusting for gasoline kind, foreign money, and units of measurement to swimsuit worldwide users. The lightweight design ensures quick calculations with out distractions from unnecessary features. Gasoline Calculator by SHPAVDA is an easy https://www.quickbooks-payroll.org/ however sensible device for estimating trip prices primarily based on mileage, gasoline consumption, and gas worth. The app generates easy-to-read PDF or CSV reviews, which may be shared immediately with accountants or employers. Past monitoring, SherpaShare supplies real-time route optimization, heat maps of busy areas, and income monitoring to help drivers maximize their earnings. Motolog has options similar to Trips, where you simply hook up with your Bluetooth car radio and neglect about it.

If you have not already, here is the method to change your person permissions so your driver can observe their mileage. Get payroll, time monitoring, and accounting information seamlessly connect, so you possibly can scale back inefficiencies and save practically four hours a week with QuickBooks Time. Financial Institution feeds, receipt seize and customized guidelines scale back handbook entry, and the mileage report exports cleanly when you need proof for taxes or reimbursements. The trade-off is accuracy, and battery utilization can lag behind specialist trackers, so teams that drive all day could need a devoted mileage app.

You don’t need to press any buttons, use additional hardware, or enter addresses, it’s totally automatic. Customers can simply classify each journey as business or personal with a easy swipe, making certain accurate tax deductions and expense reports. The app offers a free Lite version for single customers to track up to forty journeys or bills manually every month.